Easy loans in Kenya offer low interest rates and smaller loan amounts compared to other options, appealing to customers with good credit. They are funds borrowed from banks, credit unions, or online lenders, repaid in monthly installments over a period of two to five years. Lender rates vary, making them accessible and attractive to borrowers.

List of Banks which Give Loan Easily in Kenya

- Stanbic Bank Kenya:

- Offers personal unsecured loans with competitive rates.

- Loan amounts range from KES 50,000 to KES 4M.

- Repayment term up to 60 months.

- Approval within 48 hours with required documents.

- NIC Personal Loans:

- Available for private consumption and development needs.

- Borrow from KES 100,000 to KES 4M.

- Repayment period from six months to 6 years.

- Top-up loans available after six months of repayment.

- Barclays Bank:

- Offers secured and unsecured loans.

- Flexible repayment options of 12 – 72 months.

- No collateral needed for unsecured loans.

- Hassle-free application process with quick approval.

- Co-operative Bank Personal Loans:

- Loans for various purposes including education, medical, and more.

- Loan amounts from KES 50,000 to KES 4M.

- Credit scoring used for application appraisal.

- Claims assessed within 48 hours.

- HF Group:

- Available for salaried individuals.

- Loan application through HF Whizz app.

- Requires standard documentation for application.

- KCB Bank:

- Unsecured loans for individuals with steady income.

- Loan amounts from KES 20,000 to KES 4M.

- No security deposit required.

- Maximum repayment period of 48 months.

- NCBA Bank Personal Loans:

- Offers secure and unsecured loans.

- Flexible borrowing options with short application process.

- Loan Protection Insurance available.

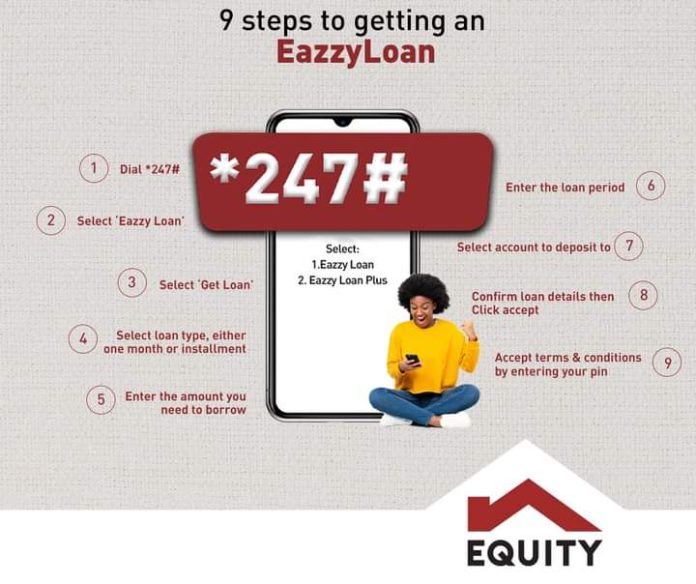

- Equity Bank Personal Loans:

- Equiloan product for salaried customers.

- Long-term facility with preferential terms.

- Maximum repayment period of 72 months.

- Loan Apps in Kenya:

- Accessible through smartphones.

- Various apps available such as Tala, Zenka, and Branch Loan.

- SACCOs:

- Deposit-taking institutions offering personal loans.

- Borrow up to six times your savings.

- Investments in authorized instruments like shares and bonds.